The project “Student at 100%. Action for the development of the student scientific movement in non-public universities” conducted by CIRSA on behalf of the Ministry of Science and Higher Education of the Republic of Poland has ended.

International Week Ostrowiec Swietokrzyski 2024

International Week Ostrowiec Swietokrzyski 2024 (April 15-18, 2024) has come to an end. We have seminars and discussion panels on intercultural education, the labor market for foreigners, cultural cooperation and the situation in Ukraine.

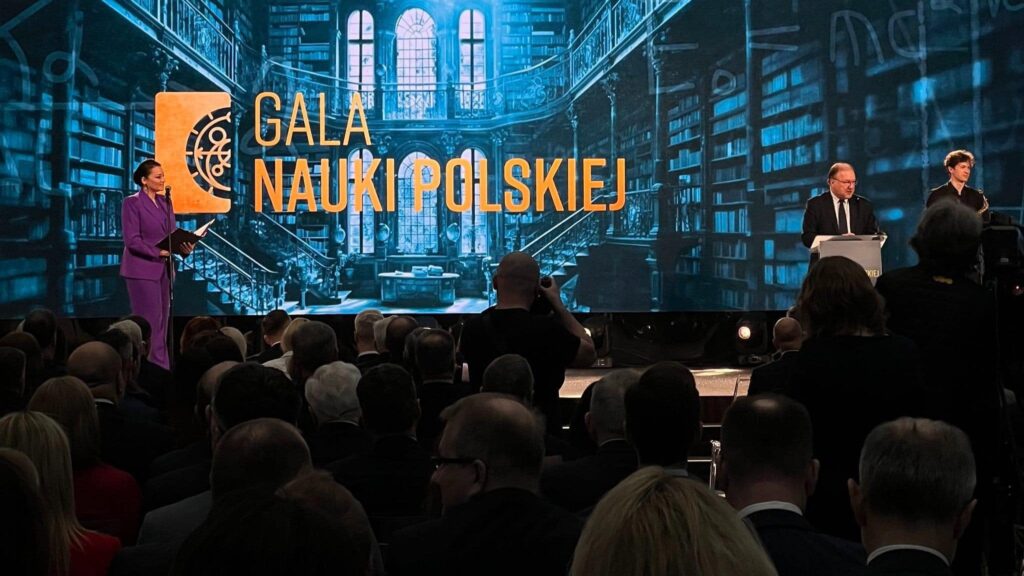

DR MONIKA BOREK PARTICIPATED IN THE POLISH SCIENCE GALA

Member of the Institute’s General Board, Monika Borek, Ph.D., M.D. participated in the Polish Science Gala, where she had a short conversation with the Minister of Higher Education, Dariusz Wieczorek.